Dallas Fed survey finds growing pessimism

March 28, 2025

Accelerating costs key challenge

The oil and gas sector saw a modest uptick in activity during the first quarter of 2025, but lingering uncertainty and rising costs are creating a challenging environment for many firms. According to the Dallas Fed Energy Survey, which gathered responses from 130 energy firms across the Eleventh District, the business activity index remained positive, though it slipped slightly from 6.0 in Q4 2024 to 3.8 in Q1 2025. Despite this minor decline, the sector appears to be holding steady, but there’s a clear shift in sentiment.

Executives surveyed showed cautious optimism at best, with the company outlook index plummeting 12 points to -4.9, signaling growing pessimism about future prospects. This shift in sentiment coincides with a significant jump in the outlook uncertainty index, which surged 21 points to 43.1. Many respondents noted the growing unpredictability of factors such as oil prices, trade policies, and the regulatory landscape.

Oil and gas production did see slight gains in Q1 2025, driven primarily by exploration and production (E&P) firms. The oil production index climbed from 1.1 to 5.6, while the natural gas production index turned positive, rising from -3.5 to 4.8. However, this modest growth is tempered by a sense of caution regarding future developments, as many firms express concerns about rising costs and diminishing margins.

Rising Costs Outpace Growth

The most concerning development for many executives is the acceleration in costs. Input costs for oilfield services companies, as measured by the input cost index, rose sharply from 23.9 to 30.9. Likewise, E&P firms reported higher finding and development costs, with the corresponding index jumping from 11.5 to 17.1. Lease operating expenses for these firms also rose significantly, from 25.6 to 38.7. With these increases outpacing production growth, many companies are feeling the pinch.

For oilfield services firms, the equipment utilization index remained relatively stable, though the operating margin index dipped further, falling from -17.8 to -21.5. However, there was a silver lining as the prices received for services index turned positive, rising from -13.0 to 7.1, suggesting that some firms were able to command higher prices for their services.

Employment in the sector was largely unchanged in Q1 2025, according to the aggregate employment index, which fell from 2.2 in the previous quarter to zero. The lack of growth in hiring suggests that companies are exercising caution in expanding their workforces amidst rising uncertainty. Similarly, the aggregate wages and benefits index showed little change, indicating that compensation levels remain steady.

One of the most significant challenges faced by oil and gas firms continues to be the rising cost of regulatory compliance. Almost half of the executives surveyed estimated their regulatory costs at $0–$1.99 per barrel, but many expect these costs to rise in 2025. In fact, 40% of respondents expect their regulatory compliance costs to remain stable, while 21% foresee slight increases and 13% expect a significant rise in 2025.

Price Expectations: Uncertainty Prevails

Looking ahead to 2025, survey respondents are uncertain about where oil prices will land, with most expecting a West Texas Intermediate (WTI) price of $68 per barrel by year-end. However, responses ranged from $50 to $100 per barrel, highlighting the wide spectrum of opinions and uncertainty surrounding the global oil market. Longer-term expectations for WTI oil prices are somewhat more optimistic, with respondents predicting $74 per barrel in two years and $82 per barrel in five years.

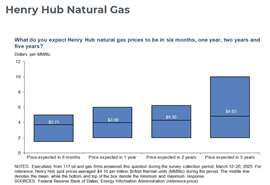

The outlook for natural gas is similarly mixed, with survey participants forecasting an average price of $3.78 per MMBtu by the end of 2025. Longer-term projections are also optimistic, with respondents expecting natural gas prices to rise to $4.30 per MMBtu in two years and $4.83 per MMBtu in five years.

Geopolitical tensions and domestic political uncertainty are major concerns for many executives. The survey highlighted the impact of steel import tariffs, with oilfield services firms fearing that rising steel costs could lead to reduced customer demand and fewer wells being completed in 2025. Several executives also voiced concerns about the administration’s policies, particularly the potential for lower oil prices due to regulatory decisions, which could negatively affect profitability.

In California, regulatory hurdles and bureaucratic delays continue to hinder investment, with one respondent noting that local government actions are preventing the development of strategically located oil and gas assets. Similarly, the impact of tariffs on steel prices, particularly casing and tubing costs, was a significant point of contention for many in the industry.

M&A Activity Slows as Consolidation Continues

Merger and acquisition (M&A) activity in the U.S. upstream oil and gas sector is expected to slow somewhat in 2025, as larger firms consolidate their holdings and focus on operational efficiency. While 37% of executives expect M&A deal values to increase slightly in 2025, the larger trend suggests a shift toward smaller, asset-level transactions rather than major corporate mergers. Executives in the oilfield services sector, in particular, are feeling the impact of this consolidation, with fewer rigs being operated and more pressure on margins.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM