IEA: India’s natural gas market set to surge

February 13, 2025

Consumption expected to grow 60% by 2030

India’s natural gas market is at a critical inflection point, with consumption set to surge by nearly 60% between 2023 and 2030, according to the International Energy Agency’s (IEA) latest India Gas Market Report. This monumental growth is powered by key drivers, including the rapid expansion of gas infrastructure, a resurgence in domestic production, and a favorable global gas market outlook. With the Indian government actively supporting natural gas consumption through policy reforms, India is set to become a dominant player in the global energy landscape by the end of the decade, the report argues.

Driving Forces Behind Growth

The report highlights three primary forces behind India’s forecasted gas boom: the expansion of gas infrastructure, a revival of domestic production, and easing global gas market conditions. These trends are projected to position India as a top consumer of natural gas, with consumption set to reach 103 billion cubic meters (bcm) by 2030—putting it on par with Saudi Arabia’s current gas usage.

City gas distribution (CGD) is the driving force behind this growth. The widespread adoption of compressed natural gas (CNG) for both residential and small industrial users will push gas consumption in urban areas to new heights. In addition, the manufacturing sector—particularly industries like steel production—will account for a significant share of this demand, adding around 15 bcm per year by 2030. India’s power sector is also set to see a dramatic increase in natural gas use, with demand for gas-fired power generation forecasted to nearly double, reaching 15 bcm per year.

While growth in the petrochemical and fertilizer sectors will be slower, the potential for natural gas to transform India’s industrial landscape remains immense. Furthermore, targeted policy strategies could accelerate gas uptake beyond projections, potentially reaching 120 bcm per year by 2030—nearly matching the current total gas consumption of South America.

A Resurgence in Domestic Production

India’s domestic gas production is on the rise after nearly a decade of stagnation. In 2023, India’s natural gas production reached 35 bcm, meeting 50% of its total demand. The resurgence is largely driven by new output from deepwater fields in the Krishna-Godavari basin, which now account for 25% of the country’s production. However, production growth is expected to moderate moving forward, with total output projected to only reach 38 bcm by 2030.

While India’s reserves of compressed biogas (CBG) are largely untapped, the government has introduced policies to bolster CBG production. With an estimated potential of 87 bcm per year, CBG could play a crucial role in India’s energy transition. Yet, logistical challenges and underdeveloped infrastructure hinder the growth of this sector. By 2030, CBG output could reach 0.8 bcm per year, but much work remains to build a robust CBG ecosystem.

LNG Imports Set to Surge

India’s LNG market has seen impressive growth in recent years, with imports reaching a record 36 bcm in 2024, maintaining its position as the fourth-largest LNG importer globally, behind China, Japan, and Korea. Since 2013, India’s LNG imports have doubled, with an average annual growth rate of nearly 8%. However, this growth has been characterized by significant fluctuations, with the highest annual growth rate of 28% observed in 2016, driven by low spot LNG prices and government subsidies for natural gas-fired power plants. In 2024, LNG imports grew by nearly 20% year-on-year, marking the second-highest growth rate of the past decade. By contrast, 2022 saw an unprecedented 17% decline due to the global energy crisis and high energy prices.

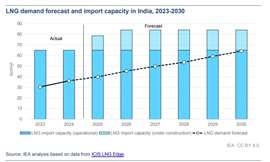

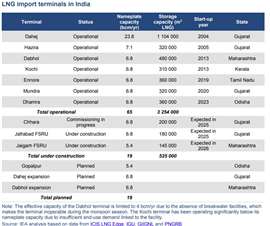

Looking ahead, India’s LNG demand is projected to grow steadily, reaching 64 bcm per year by 2030. This represents an annual growth rate of approximately 11% from 2023 to 2030—double the average rate observed in the previous decade. As domestic natural gas production is projected to see only modest growth, LNG imports will be crucial to meet the country’s future gas demand.

India’s LNG requirements will be supported by a combination of long-term contracts and increased spot market purchases. Balancing contracted LNG supply with the need for spot market flexibility will be essential to ensure supply security and cost-effectiveness. To accommodate the rapid rise in LNG imports, India will need to expand its LNG import capacity, particularly in the latter half of the decade. The gap between contracted LNG supply and projected demand could widen significantly after 2028, leaving India more vulnerable to fluctuations in the spot market unless new long-term contracts are secured in the coming years.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM