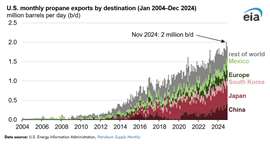

In 2024, U.S. propane exports surged to unprecedented levels, averaging 1.8 million barrels per day (b/d), the highest since the U.S. Energy Information Administration (EIA) began tracking data in 1973.

This growth marks the 17th consecutive year of increasing propane exports, driven by a combination of rising global demand, particularly in East Asia, and favorable pricing differentials between U.S. and global propane markets.

For decades, propane has been a crucial energy source in residential and commercial sectors, primarily for space heating. Additionally, it plays a vital role in the production of plastics as a feedstock for petrochemical processes that produce propylene and ethylene. These compounds are key ingredients in manufacturing polypropylene—a versatile plastic used in everything from car interiors to personal protective equipment.

Several factors are driving the trend, and they all point to the booming energy landscape in the United States.

At the heart of the export boom is a dramatic rise in U.S. propane production, which has increased significantly over the past decade. Propane is a byproduct of natural gas processing and crude oil refining, and the growing supply of natural gas in the U.S. has helped bolster propane production. With higher production volumes, U.S. propane prices have remained relatively low compared to those in Asia, making American exports highly attractive to international buyers.

The U.S. Gulf Coast, in particular, has been a central hub for propane production. Propane’s price advantage, coupled with robust production capabilities, has helped fuel a rapid expansion of exports. In November 2024, U.S. propane exports broke new ground, surpassing 2 million b/d for the first time in history. This growth was driven by surging demand from Asia, particularly China, and the need for propane in petrochemical applications like polypropylene production.

Alongside increased production, investments in infrastructure have played a pivotal role in supporting higher export volumes. Starting in 2019 and continuing through 2023, U.S. propane export terminals underwent significant expansion projects. These upgrades have enabled the United States to ship an additional 700,000 b/d of propane, a necessary step to accommodate the soaring demand from international markets.

The strategic location of U.S. propane export terminals along the Gulf Coast has provided a competitive edge, enabling propane to reach distant markets with relative speed. In fact, U.S. propane is increasingly reaching East Asia in record quantities, facilitated by the infrastructure enhancements.

Asia has emerged as a key market for U.S. propane, particularly in Japan, South Korea, and China. In 2024, U.S. propane exports to Asia grew by 13%, marking a 131,000 b/d increase. Of that, China accounted for the lion’s share, with U.S. exports to the country jumping by 40%. This surge in demand is largely driven by China’s increasing need for propylene, which is used to produce polypropylene and other plastics. The rise of new propane dehydrogenation units in China has played a key role in this growth, converting propane into propylene to meet the needs of China’s robust manufacturing sector.

For the first time in 2024, the United States became China’s top propane supplier, accounting for 32% of the country’s propane imports, surpassing even long-standing suppliers like Iran and Qatar. Despite ongoing geopolitical tensions and trade tariffs, China has continued to favor U.S. propane, as the product remains competitively priced compared to other global sources.

One of the key drivers behind the growth of U.S. propane exports is the price differential between U.S. propane and global propane benchmarks, particularly in East Asia. In 2023, the price difference between propane in the U.S. and East Asia reached 42 cents per gallon—the widest spread since 2014. This gap widened further in 2024, increasing to 43 cents per gallon, making U.S. propane even more attractive to East Asian buyers who were eager to capitalize on lower prices.

However, it’s not just the lower cost of propane that’s driving this demand. The growing capacity for propylene production in East Asia has also bolstered demand for propane as a key feedstock. Even though the region’s propylene prices have fallen to their lowest levels in years, the need for propane remains strong, ensuring that U.S. exports continue to flow at record levels.

While Asia has seen explosive growth, U.S. propane exports to Europe were more stable in 2024. After Russia’s invasion of Ukraine, European Union countries pivoted away from Russian propane and increased imports from the U.S. In 2023, U.S. exports to Europe hit a new high of over 200,000 b/d. Though these exports remained roughly flat in 2024, Europe’s continued reliance on U.S. propane underscores the changing dynamics in the global propane market.

Despite the overall success of U.S. propane exports, the path from the U.S. Gulf Coast to East Asia is not without its challenges. The Panama Canal, which serves as a key transit route for U.S. exports to Asia, has been facing water level issues that slowed traffic in 2023. This resulted in higher shipping costs and delayed shipments, further driving up propane prices in East Asia. However, by the end of 2024, the canal’s water levels had rebounded, restoring normal operations and allowing freight rates to drop by 33% compared to the previous year.