The right time for rich-burn engines

January 26, 2023

Since 2011, the EPA’s GHGRP has collected annual emissions data from nearly 8000 large industrial facilities. (Photo: Adobe.)

Since 2011, the EPA’s GHGRP has collected annual emissions data from nearly 8000 large industrial facilities. (Photo: Adobe.)

Natural gas production in the US averaged more than 100 billion cubic feet per day (Bcf/d) in October and November as 2022 is likely to go down in history with a record average of 98.0 Bcf/d for the year. The Energy Information Administration (EIA) forecasts production to grow at approximately 2% in 2023, averaging between 100 Bcf/d and 101 Bcf/d.

A commitment by the US to supply an additional 530 Bcf of liquified natural gas (LNG) to European countries to support European efforts to expand their gas supply sources had US LNG flowing to Europe at record levels throughout 2022. A study released by the American Petroleum Institute (API) and the International Association of Oil and Gas Producers (IOGP) found that Europe’s demand for LNG is projected to increase 150% from 2021-2040.

In parallel, there is ever-increasing recognition that the world needs to limit the impact of climate change, and as the second-most-abundant greenhouse gas (GHG) after carbon dioxide, methane is a big target. Investors, shareholders, governments and communities alike are scrutinizing the carbon intensity associated with the production of fossil fuels, and this is driving energy producers to seek new and innovative ways to reduce their methane emissions.

Natural gas-fired engines, also known as prime movers, providing mechanical power for the compressors located along the 3 million miles of pipelines zigzagging across the lower 48 states are typically separated into three distinct classes: two-cycle (stroke) lean burn, four-stroke lean burn and four-stroke rich burn that have a lifespan of 50-60 years. Why do the three distinct classes matter?

Greenhouse Gas Reporting Program (GHGRP)

They matter because the US Environmental Protection Agency (EPA) is proposing amendments to specific provisions of the Greenhouse Gas Reporting Program (GHGRP) to improve the quality of data collected under the program. Since 2011, the EPA’s GHGRP has collected annual emissions data from nearly 8000 large industrial facilities and other sources in the US that emit 25,000 metric tons of CO2 equivalent (mtCO2e) or more per year. According to the EPA, the proposed revisions would further enhance the quality of the data from the Petroleum and Natural Gas Systems source category (Subpart W) so that the GHGRP continues to serve as a tool for both EPA and the public to understand emissions from this sector.

Studies cited in the proposed GHGRP rule indicate that a significant portion of emissions can result from unburned methane entrained in the exhaust of natural gas compressor engines — also referred to as “combustion slip” or “methane slip.” The studies further assert that emissions from natural gas compressor engines included in the GHGRP are significantly underestimated because they do not account for combustion slip.

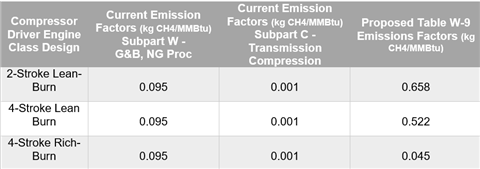

Therefore, the EPA is proposing to revise methodologies for determining combustion emissions from compressor engines to account for combustion slip. Reporters would use subpart-W-specific emission factors by engine design class (e.g., two-stroke lean-burn, four-stroke lean-burn, four-stroke rich-burn or other) in proposed new Table W-9. In the original proposal, the EPA said that the revisions would become effective on Jan. 1, 2023, and that reporters would implement the changes beginning with reports prepared for the 2023 reporting year and submitted Apr. 1, 2024. As of this publication, it is unclear when the new emission factors will go into effect. See Figure 1 for comparisons of current versus proposed emission factors.

Figure 1: Current GHGRP emission factors compared to Table W-9 to subpart W of Part 98 proposed default methane emission factors for natural gas-fired compressor-drivers.

Figure 1: Current GHGRP emission factors compared to Table W-9 to subpart W of Part 98 proposed default methane emission factors for natural gas-fired compressor-drivers.

As is made apparent by the proposed emission factors, four-stroke, rich-burn engines simply and inherently emit less methane. Rich-burn engines operate near the stoichiometric air-to-fuel ratio (16:1) where theoretically 100% of the fuel and oxygen is consumed during combustion. In reality this is about a 99.7% combustion efficiency and results in a more than 90% methane emission reduction. With the appropriate exhaust aftertreatment systems, the emission values level out so that almost the same conditions can be achieved for lean- and rich-burn engines.

Inflation Reduction Act (IRA)

In yet another parallel, in August 2022, President Joe Biden signed the Inflation Reduction Act (IRA), which includes a charge on methane emissions from selected entities in the oil and gas industry. The methane emissions charge applies to facilities that are required to report their GHG into the GHGRP. Beginning January 1, 2024, the charge starts at $900 per metric ton of methane and increases to $1500 after two years which equates to $36 and $60 per metric ton of carbon dioxide equivalent, respectively.

The IRA methane charge applies to a subset of the petroleum and natural gas system facilities that are required to report GHG emissions including multiple midstream applications: onshore and offshore petroleum and natural gas production, onshore natural gas processing, onshore natural gas transmission compression, underground storage, onshore petroleum and natural gas gathering and boosting and transmission pipelines.

The scope of emissions subject to the charge is based on the facility’s reported emissions under EPA’s GHGRP and an emission threshold that varies by facility type:

- For petroleum and natural gas production facilities, the charge applies only to the number of reported tons of methane that exceed 0.2% of the natural gas sent to sale from such a facility.

- For nonproduction facilities, such as gathering and boosting facilities, the charge applies to methane emissions that exceed 0.05% of the natural gas sent for sale from the facility.

- For natural gas transmission facilities, the charge applies to methane emissions that exceed 0.11% of the natural gas sent for sale from the facility

With the proposed changes to the GHGRP to account for methane slip more accurately in engine exhaust, compounded with IRA’s methane charge, with 90% lower methane emissions, rich-burn engines are able to sustainably meet the growing demands of the fossil fuels production, making it the “right time for rich-burn.”

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM