Heading into winter, gas prices only slightly higher

November 25, 2024

But supply risks loom, EIA warns

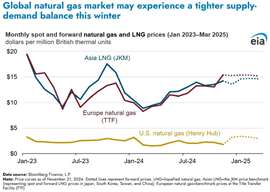

Natural gas prices heading into the winter season are only slightly higher compared to last year, according to the U.S. Energy Information Administration (EIA), based on current forward prices for natural gas and liquefied natural gas (LNG) in Europe and Asia. However, the EIA cautioned that a variety of factors could lead to price volatility in the coming months.

“If weather remains mild this winter, as it has in the past two winters, we expect a stable global supply-demand balance with prices similar to the previous two winters,” the EIA said. “But if Europe and Asia experience colder temperatures or other market disruptions, global supply-demand balances could tighten, potentially driving prices higher and causing spikes.”

Several key factors could impact the natural gas market this winter:

- LNG Supply Growth: Limited additions to LNG production capacity are expected this winter, with most new supply coming from the U.S.

- Shifts in Pipeline Flows: Europe could see reduced pipeline imports of natural gas, particularly if the Russia-Ukraine gas transit contract, set to expire at the end of 2024, is not renewed.

- Operational Risks: Delays in new project startups, unplanned outages at LNG export facilities, and geopolitical risks could further limit LNG availability.

- Weather Variability: The transition from El Niño to La Niña could result in a colder winter, increasing natural gas demand and intensifying competition for LNG between Europe and Asia. A particularly cold winter in the U.S. could lower storage inventories and raise domestic prices, further driving up LNG export prices.

- Power Generation: Shifts in electricity supply and demand—such as issues with nuclear power or renewable energy output—could increase reliance on LNG for power generation, further influencing demand.

Despite these risks, global natural gas prices have been on a downward trend throughout 2024. As of October, LNG futures prices in East Asia (JKM) and Europe (TTF) had fallen by more than 50% compared to 2022, and more than 20% compared to 2023, according to data from Bloomberg Finance. For the period January to October, JKM prices averaged $11.47 per million British thermal units (MMBtu), while TTF prices averaged $10.37/MMBtu. This decline has been largely attributed to high inventories in Europe, reduced natural gas consumption, and stable global supply.

For the upcoming winter, forward prices at TTF and JKM are hovering around $15/MMBtu, indicating that prices will be slightly higher than last winter but still lower than in previous years.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM