Read this article in 中文 Français Deutsch Italiano Português Español

Western U.S. natural gas reaches highest spot prices since 2000

January 04, 2023

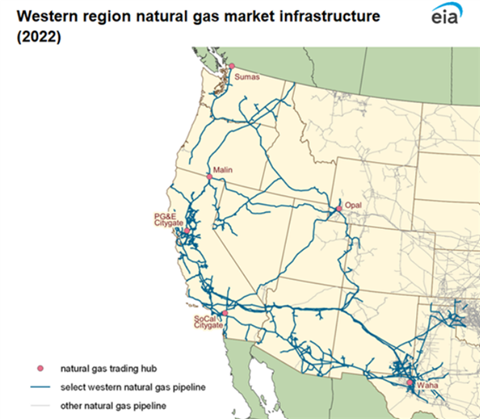

Map of natural gas pipelines and hubs in the western U.S.

Map of natural gas pipelines and hubs in the western U.S.

Spot prices for natural gas in three major hubs in the western U.S. surged abruptly in December as the market responded to strong demand and constrictions in supply, according to data from the U.S. Energy Information Administration (EIA.)

On Dec. 21, 2022, natural gas spot prices at three major trading hubs in the western U.S. rose above $50.00/MMBtu. Those spot prices were the highest of any other market and an average of $48.12/MMBtu above Henry Hub. The three hubs that exceeded $50.00/MMBtu are Pacific Gas & Electric (PG&E) Citygate ($57.07/MMBtu), Sumas on the Canada-Washington border ($50.33/MMBtu) and Malin, Oregon ($55.38/MMBtu) — a fourth hub, SoCal Citygate, came in at $49.67/MMBtu in mid-December 2022.

The figures for PG&E and Malin are the highest spot prices since December 2000, though SoCal Citygate and Sumas have recorded much higher prices in the $140-160/MMBtu range in 2021 and 2019, respectively.

The EIA said that several factors contributed to the rising spot price levels:

- Widespread below-normal temperatures

- High natural gas consumption

- Reduced natural gas flows

- Pipeline contraints (inlcuding maintenance in western Texas)

- Low natural gas storage levels in the Pacific region

From late Novemver to mid-December 2022, the region that stretches from western Canada to California experienced temperatures colder than normal, which led to an increased demand for natural gas. According to the EIA, natural gas consumption in the Pacific Northwest and California spiked by 23% in the first three weeks of December compared to the second half of November. Data from Point Logic showed that in the selectric power sector, natural gas consumption increased 14% over the same timeframe.

The natural gas infrastructure struggled to keep up with the higher demand: From mid-November to late December, net natrual gas flows from Canada were down 4%, and natural gas deliveries from the Rocky Mountains were 9% lower.

Maintenance in western Texas contributed to reduced pipeline capacity and lower westbound natural gas flows. As of Dec. 16, 2022, the Pacific region natural gas storage inventories were 25% below year-ago levels and 30% below the five-year average.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM