U.S. LNG exports expected to average 11.3 Bcf/d in 2022

February 28, 2022

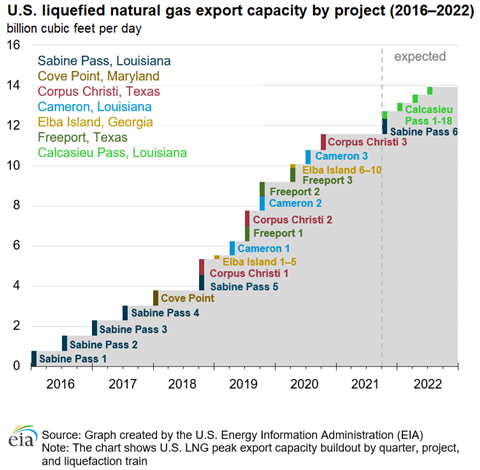

U.S. LNG exports should continue to climb, averaging 11.3 Bcf/d for the entire year, an increase of 16% from 2021, according to the latest forecast from the U.S. Energy Information Administration. The forecast for LNG exports is up from 11.2 Bcf/d seen in January, up from 10.4 Bcf/d in 4Q21.

The large price differences between the Henry Hub price in the United States and spot prices in Europe and Asia continue to support the growth in LNG exports. In addition, inventories in Europe remain much lower than their five-year averages and are contributing to strong demand for LNG imports, the EIA reported.

“The forecast reflects our assumptions that global natural gas demand remains strong and that expected additional U.S. LNG export capacity comes online,” the agency stated in its latest Short-Term Energy Outlook. Colder-than-normal temperatures in January resulted in U.S. natural gas inventories falling below the five-year average to end the month at 2.3 trillion cubic feet (Tcf.)

The agency forecast natural gas inventories would fall by about 730 Bcf for the rest of the withdrawal season, which ends in March, to just below 1.6 Tcf. That level of inventories would be 8% less than the 2017–21 average for that time of year.

Meanwhile, U.S. consumption of natural gas will average 105.2 billion cubic feet per day (Bcf/d) in February, down 3% from February 2021. “Consumption in our forecast declines the most in the residential and commercial sectors, where consumption will average a combined 43.8 Bcf/d, down 10% from last February,” the EIA reported in its latest Short-Term Energy Outlook.

The agency forecast that gas consumption among electric power producers will reach 27.8 Bcf/d in February, down 1% from last February. The changes are partly offset by industrial sector consumption, which grows by 4% from February 2021 in the forecast to average 24.8 Bcf/d for the month, the EIA reported.

U.S. natural gas production averaged 95.5 Bcf/d in the United States in January, down 2.1 Bcf/d from December 2021. Production in January was lower due, in some part, to freezing temperatures in certain production regions.

“We forecast natural gas production to average 95.6 Bcf/d in February and 96.1 Bcf/d for all of 2022, driven by natural gas and crude oil price levels that we expect will be sufficient to support enough drilling to sustain production growth,” the agency wrote.

Looking further forward, gas production is expected to reach 98.0 Bcf/d in 2023.

In January, the natural gas spot price at Henry Hub averaged $4.38 per million British thermal units (MMBtu), up from the December average of $3.76/MMBtu. Higher prices in January were a result of colder-than-normal weather in parts of the country, particularly the Northeast and the Midwest where demand increased for natural gas used for space heating and for power generation.

The price forecast is rife with uncertainty because winter weather forecasts are highly variable. In addition, global demand for U.S. liquefied natural gas (LNG) has remained high, limiting some of the downward pressure on natural gas prices.

The agency predicted gas prices could remain volatile over the coming months, and the way that temperatures affect natural gas demand in February and March will be a key driver of how inventories end the withdrawal season, which will be important for natural gas price formation in the coming months.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM