Two More Pipelines Online In Mexico

July 13, 2018

The U.S. Energy Information Administration reports that two new pipelines carrying U.S. natural gas exports within Mexico were placed in service in June.

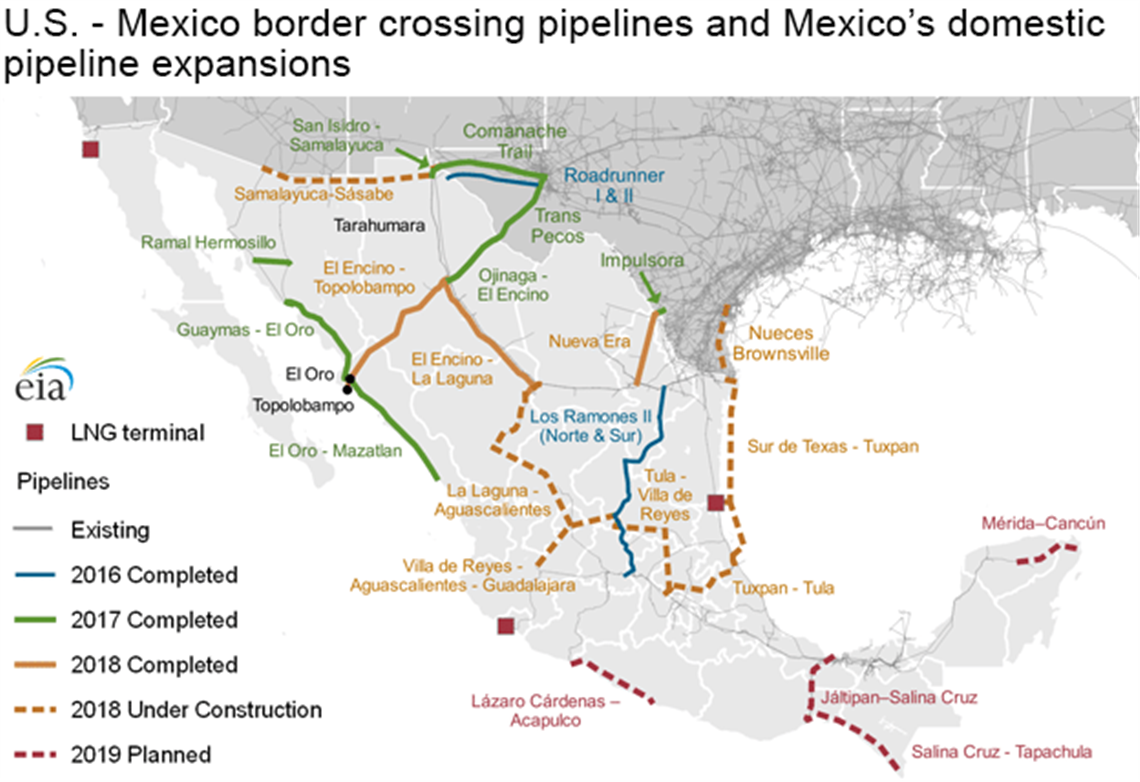

The pipelines are the Nueva Era pipeline system, which includes the Impulsora pipeline in southern Texas and transports natural gas from the Eagle Ford producing basin to Monterrey, Nuevo León; and the El Encino-Topolobampo pipeline, which transports natural gas from the Permian producing basin in western Texas from interconnections with existing pipelines (Ojinaga-El Encino and Tarahumara) further into Mexico’s northwestern states of Sonora and Sinaloa.

The Nueva Era pipeline is a 504 MMcf/d-capacity pipeline that will primarily serve the industrial customers and several natural gas-fired power plants near Monterrey, Nuevo León.

El Encino-Topolobampo pipeline has a capacity of 670 MMcf/d and is part of a two-segment El Encino-Mazatlan system. El Encino-Topolobampo transports natural gas from central Mexico’s state of Chihuahua to Topolobampo, state of Sinaloa in the western part of the country. The second segment—an existing El Oro-Mazatlan pipeline—transports natural gas farther south into Sinaloa. El Encino-Topolobampo will deliver natural gas to an existing 320 MW Juan de Dios Batiz Paredez plant and to two new CCGT plants, Topolobampo II (778 MW) and Topolobampo III (777 MW), scheduled to come online sometime in 2019–20. The El Oro-Mazatlan segment will supply natural gas to the 300 MW Mazatlan II power plant. El Encino-Topolobampo will also supply natural gas to Guaymas-El Oro pipeline and two CCGT power plants—Empalme I and II (capacity 747 MW each).

U.S. natural gas pipeline exports to Mexico have increased following major expansions of U.S. border crossing capacity in recent years. In particular, capacity from West Texas has increased by 3.1 Bcf/d since 2016. In addition, the recently approved expansion of Tennessee Gas Pipeline’s border crossing export points at Hidalgo and Rio Bravo in south Texas will increase capacity by an additional 0.4 Bcf/d. However, despite this significant increase in U.S. border crossing pipeline capacity, exports from western Texas (Waha-Permian production areas) averaged 0.6 Bcf/d in January-April 2018 (export capacity utilization around 14%) because of the delays in construction of the connecting pipelines on the Mexican domestic network, the EIA reports.

In the near term, EIA forecasts that U.S. natural gas exports to Mexico will increase, as more connecting pipelines in Mexico are completed. Currently, there are six major pipelines under construction in Mexico identified as strategic pipelines in Mexico’s five-year natural gas infrastructure expansion plan, which are scheduled to come online this year, according to Mexico’s Secretaría de Energía. These pipelines will transport U.S. natural gas further into Mexico’s northwestern and central regions (see map). However, since the originally planned in-service dates, Mexican pipeline projects have been delayed on average one year or more, according to Genscape, in part because of the opposition from Mexico’s indigenous tribes contesting the pipelines’ chosen routes.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM