TCO and the life of an electric machine

14 August 2024

Italy’s Flash Battery has published details covering total cost of ownership of machines with various powertrain types.

Source: Flash Battery

Source: Flash Battery

Total cost of ownership (TCO) remains a key consideration when planning the purchase of a new industrial vehicle or mobile working machine. This is even more important when buying an electric or hybrid vehicle, particularly when the machine is an essential element of the owner’s income.

Basic cost is a primary concern, but working out the TCO can highlight how investing in a new machine should be evaluated beyond the initial purchase price.

Across most of the European Union, a move to more sustainable technologies is part of the policy shift intended to support environmental protection goals (as in the EU’s Green Deal 2050). In these areas, manufacturers of off-highway machinery and industrial vehicles will have to manage compliance with these new regulations by selecting either a hybrid (IC engine/battery-electric powertrain) or a pure-electric vehicle.

Lithium-ion battery packs produced by Flash Battery. (Photo: Flash Battery)

Lithium-ion battery packs produced by Flash Battery. (Photo: Flash Battery)

Italy-based lithium-ion battery manufacturer Flash Battery has carried out an analysis of the TCO when it comes to electrification of mobile working machines or industrial vehicles to offer the prospective buyer a clearer scenario of future outgoings.

As manufacturers have either used conventional lead-acid batteries or the more efficient lithium chemistry, Flash Battery’s evaluation compares an ICE vehicle with equivalent models using lead-acid batteries and another using a lithium battery solution.

Currently, the main difference in price between a lithium battery-powered vehicle and an ICE or lead-acid model is the cost of the lithium battery pack. A full TCO analysis can determine the true financial advantages of choosing lithium batteries.

According to Flash Battery, an accurate TCO has some crucial factors, including fixed and variable expenses, which must be considered:

- purchase price

- maintenance costs

- fuel

- impact of bonuses and funding for conversion to electric

TCO calculation

Over the 12 years Flash Battery has been producing industrial lithium batteries, the company has worked with many OEMs from different industries as they made the switch to lithium.

“Total cost of ownership will continue to be a vital fast-track tool in the transition to electric power.” Marco Righi, founder and CEO of Flash Battery (Photo: Flash Battery)

“Total cost of ownership will continue to be a vital fast-track tool in the transition to electric power.” Marco Righi, founder and CEO of Flash Battery (Photo: Flash Battery)

Based on a real-world example of working with a customer in the industrial electric vehicles space, where Flash Battery guided the client through the process of retrofitting its lead battery-powered vehicles with lithium packs, the company analyzed the case scenario in detail.

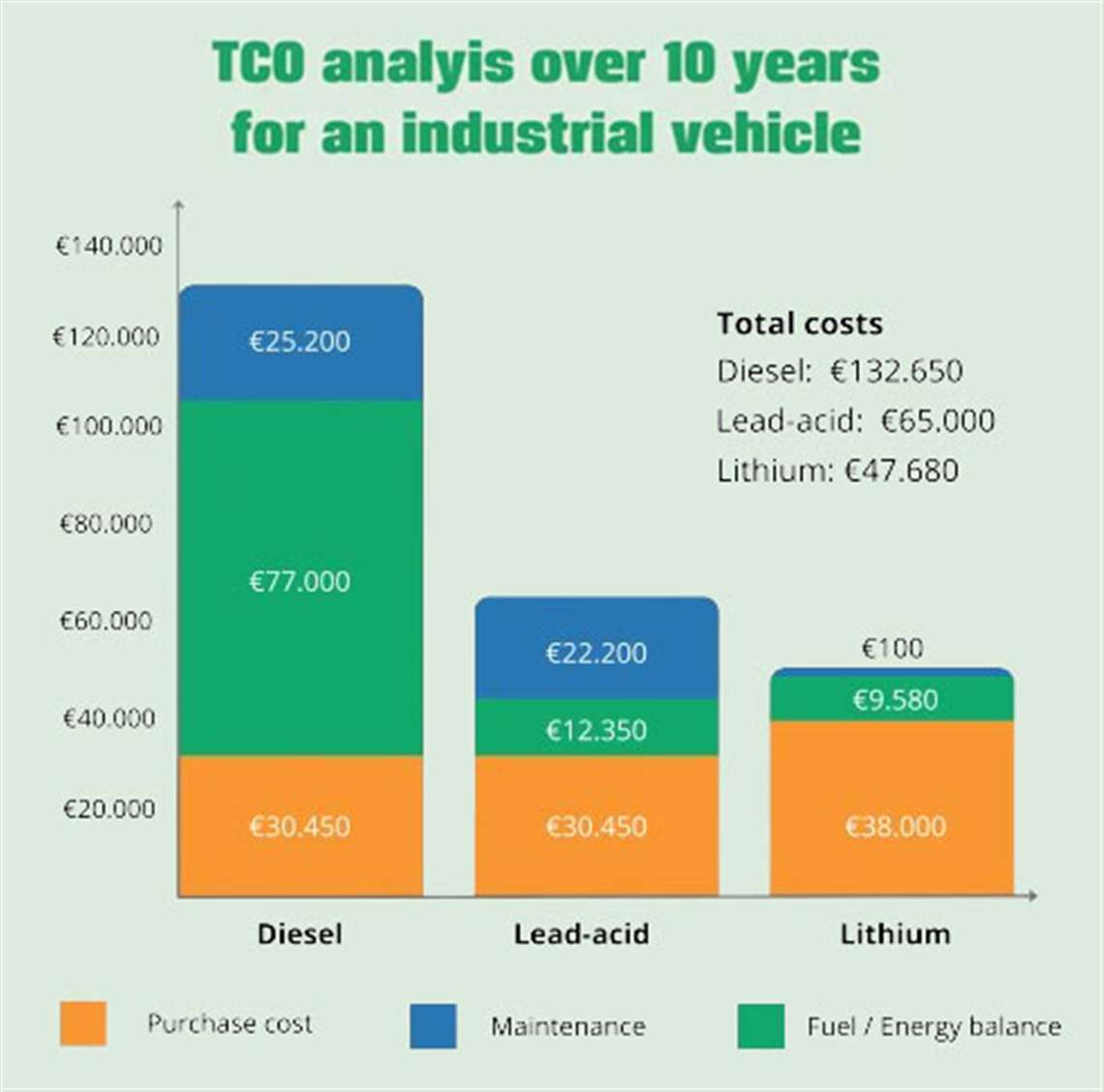

The TCO analysis for the same vehicle powered by diesel, lead acid batteries or lithium batteries is shown in the related graph. The information covers a 10-year period and includes the vehicle’s initial cost, maintenance costs and energy balance/fuel costs.

The following gives more detail about the individual cost case elements:

Purchase price

The purchase price is the initial investment that the client has to spend when making the decision to purchase the vehicle.

While a lithium battery-powered vehicle has a higher initial cost, the graph indicates that when maintenance and fuel costs/energy balance are taken into account, the initial investment is recouped within the given timeframe.

Maintenance

The amount that maintenance adds to the total cost of ownership is readily apparent: vehicles using lithium batteries have substantially lower operating costs.

According to Flash Battery, an electric powertrain’s lower technical complexity simplifies maintenance and avoids the need for regular replacement of an entire component sets in an ICE vehicle due to wear and tear.

In the case of lead-acid batteries, routine maintenance (including water refills, maintaining the filling circuit, keeping parts and terminal poles free of corrosion), is one of the highest costs. But there are other factors to using lead batteries, such as the cost for indoor charging facilities. These require a dedicated space due to the gases released when being charged, with a further cost for extraction and disposal of those gases. Lead-acid batteries also must be replenished with demineralized water, thereby needing a water demineralization system.

Source: Flash Battery

Source: Flash Battery

Energy balance/fuel

Electricity is currently considered more economical than diesel. Electric vehicles are more energy efficient than their ICE counterparts (80% vs 30%), while electricity prices are typically less volatile than the price of oil and its derivatives.

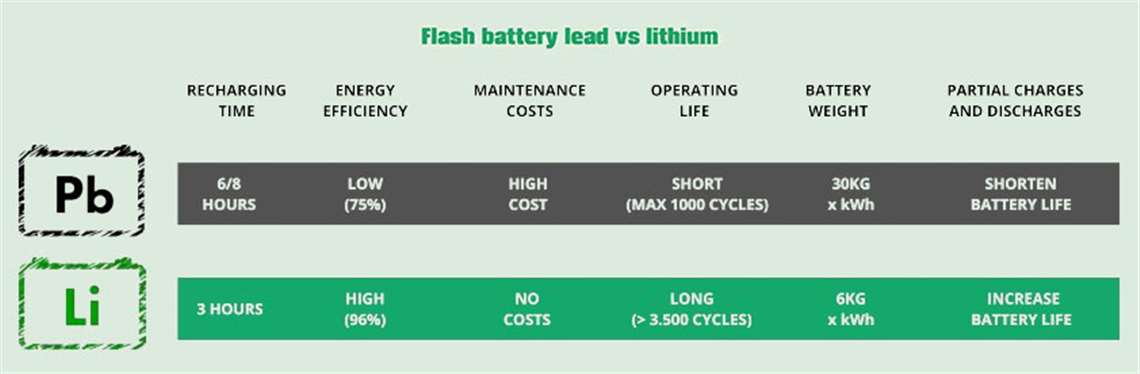

Lead versus lithium

A lead battery’s useful life is about four times shorter than a lithium battery (1,000 charging cycles compared to 3,500 cycles). Lead batteries also have a low charging efficiency, returning a rate of about 75% as opposed to 96% for lithium batteries.

Lead batteries also require six to eight hours for a full charge. In contrast, lithium batteries support partial and fast charging, allowing them to be charged multiple times during the day and over a shorter time. A dead lead-acid battery has to be switched out and left in a special room to charge after eight hours of use.

TCO analysis for an industrial tractor over a period of 10 years and with one/two duty cycles per day. Source: Flash Battery

TCO analysis for an industrial tractor over a period of 10 years and with one/two duty cycles per day. Source: Flash Battery

Lead batteries are also larger and heavier than lithium models. This can have a significant impact on logistics, considering replacement time and the risk posed to workers. All these variables add to total operating costs.

According to Flash Battery, the comparison highlights that electrification of industrial machinery or vehicles with lithium batteries is a financially sound choice. Despite the larger initial investment, the TCO analysis reveals a more advantageous bottom line over time.

“Total cost of ownership is becoming an important lever and will continue to be a vital fast-track tool in the transition to electric power for an increasing number of industries,” said Marco Righi, founder and CEO of Flash Battery. “By providing a clear and transparent view of the financial benefits of switching to electric, the TCO review serves as a strategic tool for producers to make informed decisions, allowing for speedier migration to more sustainable solutions with a reduced environmental effect.”

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM