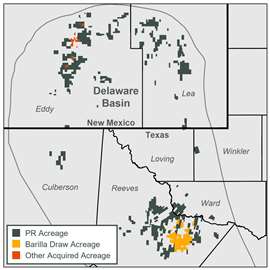

Permian Resources adds Delaware basin acerage

July 29, 2024

Deal with Occidental valued at US$817.5 million

Permian Resources will spend US$817.5 million for Occidental acreage in the Delaware basin.

Under the deal, Permian Resources will get 29,500 net acres, ~9,900 net royalty acres and ~15,000 Boe/d predominantly located directly offset the company’s existing position in Reeves County, Texas. The effective date of the transaction is July 1, with closing expected to occur by the end of the third quarter of 2024.

“This acquisition is a natural fit for us given its high-return inventory and proximity to our current operated position,” said Will Hickey, Co-CEO of Permian Resources. “As the Delaware Basin’s low-cost leader, we are highly confident that our team will be able to leverage its operational expertise of the asset to significantly reduce costs and drive meaningful synergies, maximizing value for our shareholders.”

“Our overarching goal is to drive value for our investors, and this acquisition of high-quality assets adjacent to our existing position is a perfect example. Consistent with our strategy of pursuing sound M&A opportunities, this bolt-on acquisition adds core inventory which immediately competes for capital and is accretive to key metrics over both the short and long-term,” said James Walter, Co-CEO of Permian Resources. “Furthermore, the substantial midstream infrastructure and surface acres represent material value and will provide us with significant flexibility going forward.”

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM