EIA: U.S. natural gas pipeline capacity expanded in 2024

March 17, 2025

Boosting delivery to key demand centers

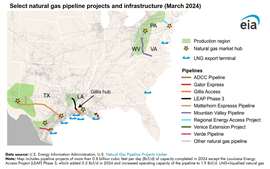

According to the latest data from the U.S. Energy Information Administration (EIA), natural gas pipeline projects completed in 2024 increased U.S. takeaway capacity by approximately 6.5 billion cubic feet per day (Bcf/d) in major natural gas-producing regions, including Appalachia, Haynesville, Permian, and Eagle Ford. These expansions are designed to better connect the nation’s production zones to critical demand hubs along the U.S. Gulf Coast and the mid-Atlantic.

Among the key projects contributing to this growth is the Mountain Valley Pipeline, operated by Equitrans Midstream Corporation. This project allows the transportation of up to 2.0 Bcf/d of natural gas from the Appalachian Basin, linking Wetzel, West Virginia, to an interconnect with the Transcontinental Gas Pipe Line Company (Transco) in Pittsylvania, Virginia.

The Regional Energy Access Project by Transco, with a capacity slightly exceeding 0.8 Bcf/d, expanded Transco’s existing infrastructure between Luzerne County, Pennsylvania, and Middlesex County, New Jersey, further enhancing regional delivery capabilities.

Also noteworthy is the Louisiana Energy Access Project (LEAP) Phase 3 by DT Midstream, which expanded the LEAP pipeline by 0.2 Bcf/d. The pipeline, now capable of transporting up to 1.9 Bcf/d, facilitates the flow of natural gas from the Haynesville region to Gulf Coast markets, connecting with other pipelines at the Gillis Hub near Ragley, Louisiana.

The Matterhorn Express Pipeline, managed by Whitewater Midstream, further strengthens the U.S. pipeline network with the capacity to move 2.5 Bcf/d of natural gas from the Permian Basin to Katy, Texas, while the Verde Pipeline from Pecan Pipeline Company, with a 1.0 Bcf/d capacity, serves the Eagle Ford region, connecting natural gas production in Webb County, Texas, to the Agua Dulce hub.

In addition to these regional pipeline projects, five major pipeline expansions aimed at supporting U.S. liquefied natural gas (LNG) export terminals added 8.5 Bcf/d of capacity. Notable among them is the ADCC Pipeline operated by Whitewater Midstream, which delivers 1.7 Bcf/d of natural gas to the Corpus Christi Stage 3 LNG project in South Texas. The Gillis Access project from TC Energy, with a capacity of 1.5 Bcf/d, provides a direct link to LNG terminals along the Gulf Coast, while the Gator Express Phase 1 & 2 from Venture Global Gator Express enables the movement of 2.0 Bcf/d to the Plaquemines LNG export terminal in Louisiana. The Venice Extension Project from Texas Eastern Transmission also bolsters LNG capacity by moving up to 1.3 Bcf/d to the same terminal.

In total, these infrastructure developments in 2024 resulted in the addition of 17.8 Bcf/d of new natural gas pipeline capacity across the country. Interstate pipelines, which cross state borders and support export demand, saw larger capacity additions than intrastate projects. This marks the second consecutive year of growth in pipeline capacity, surpassing the previous year’s totals.

These pipeline expansions reflect the ongoing transformation of the U.S. energy sector, responding to increasing natural gas demand, both domestically and internationally, and positioning the country as a key player in global energy markets.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM