Read this article in Français Deutsch Italiano Português Español

EIA: Record low Henry Hub average price in 2024

January 08, 2025

Record low prices when adjusted for inflation

In 2024, the U.S. benchmark Henry Hub natural gas spot price averaged just $2.21 per million British thermal units (MMBtu), marking the lowest average annual price in inflation-adjusted terms ever reported. This sharp drop in prices reflects a broader trend driven by robust natural gas supply and weak demand, significantly affecting the energy market, according to the U.S. Energy Information Agency (EIA).

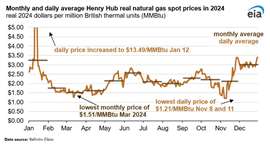

The annual average Henry Hub natural gas price in 2024 represents a 16% decrease from the previous year and an eye-popping 68% decline from 2022, making it the largest two-year drop on record, according to the EIA. Over the course of the year, the price fluctuated considerably, with the monthly average ranging from $3.25/MMBtu in January to an all-time low of $1.51/MMBtu in March. This marked the narrowest range of monthly prices in recent years, with the 2024 range of $1.74/MMBtu significantly lower than the five-year average of $2.32/MMBtu.

Throughout 2024, the Henry Hub price set multiple daily and monthly records for the lowest prices ever recorded. Inflation-adjusted figures for February, March, April, and August revealed the lowest monthly prices in history, and the year also witnessed the four lowest daily prices ever documented. This decline is attributed to a combination of factors, including a robust domestic natural gas supply and an overall reduction in demand.

While the first quarter of the year saw a substantial dip in prices, a key exception occurred in January, when a cold snap swept across much of the U.S., causing a surge in demand for natural gas to meet heating needs. The Henry Hub price peaked on January 30 at $13.49/MMBtu, the highest daily price of the year. However, following this spike, the price steadily decreased as demand moderated, and natural gas production remained strong.

A warm winter season and relatively mild temperatures during the early months of 2024 contributed to a significant reduction in demand for natural gas, further driving down prices. Additionally, U.S. natural gas storage levels were higher than usual, with inventories at the end of the 2023–24 winter heating season (March 31) reaching 2,306 billion cubic feet (Bcf). This was 25% higher than the same time the previous year and 39% above the five-year average, contributing to lower prices in the first quarter.

In the spring, the natural gas market saw a continuation of the low-price trend. U.S. natural gas consumption typically drops in April and May as the residential and commercial sectors require less heating. In these months, the spot price averaged $1.62/MMBtu in April and $2.14/MMBtu in May, both of which were record lows when adjusted for inflation. At the same time, little change in U.S. liquefied natural gas (LNG) export capacity and relatively stable domestic demand further constrained price growth.

Throughout the summer, as air-conditioning demand spiked, U.S. natural gas consumption in the electric power sector increased, putting pressure on natural gas storage. Despite this, overall storage levels remained high, and injections into storage were lower than average. Nevertheless, the U.S. natural gas market entered the winter of 2024–25 with the highest natural gas inventories since 2016, positioning the market favorably for the colder months.

The spot price of natural gas began to increase in December as winter temperatures returned to normal, boosting demand for space heating. This price uptick marks a typical seasonal adjustment, with natural gas usage typically rising during the colder months. Despite the December increase, the overall picture of 2024 is one of historically low prices, driven by an oversupply of natural gas and relatively flat demand patterns.

As the 2024–25 winter heating season begins, the EIA expects prices to increase moderately. According to the EIA’s Winter Fuels Outlook, U.S. residential energy consumption, including natural gas, is expected to rise slightly, but overall, consumers may benefit from the lower prices seen during much of 2024.

The natural gas market’s performance in 2024 underscores the balancing act between supply and demand in the energy sector. With abundant domestic production, a mild winter, and stable storage levels, natural gas prices have remained historically low, offering some relief to consumers but also highlighting the dynamic forces at play in the energy landscape. As the U.S. enters the winter of 2024–25, attention will turn to how the natural gas market adjusts to seasonal changes in demand and whether prices will continue to fluctuate as they did throughout the previous year.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM