EIA raises natural gas price expectations

February 11, 2025

Cold snap in U.S. depleted storage

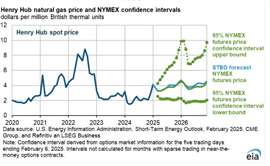

In its February Short-Term Energy Outlook (STEO), the U.S. Energy Information Administration (EIA) updated its forecast for U.S. natural gas prices, reflecting the impact of a cold snap that struck at the end of January. The EIA now expects the average Henry Hub natural gas spot price to rise to nearly $3.80 per million British thermal units (MMBtu) in 2025, an increase of 65 cents from its previous projection in January. This revision follows a spike in prices earlier in January, when the spot price averaged $4.13/MMBtu and reached a high of $9.86/MMBtu on January 17 due to a cold wave and above-average withdrawals from storage.

Looking further ahead, the EIA anticipates natural gas prices will continue to climb, averaging close to $4.20/MMBtu in 2026. Despite this, other energy forecasts in the STEO remain largely unchanged, particularly with regard to the U.S. electricity generation outlook. The EIA projects a 2% increase in electricity generation for 2025 and a 1% increase for 2026, building on a 3% rise in 2024. Growth will be driven by renewable energy sources, particularly solar, which is expected to grow from 5% of the U.S. electricity generation mix in 2024 to 8% by 2026, thanks to a planned 45% increase in solar capacity.

On the other hand, natural gas’s share of U.S. electricity generation is expected to decline from 43% in 2024 to 39% by 2026, as rising natural gas prices limit its use in power generation. These shifts reflect the increasing role of renewables in the energy mix, with both solar and wind generation benefiting from planned generator projects.

Additionally, the EIA’s forecasts are based on macroeconomic assumptions that were finalized prior to the imposition of new tariffs on Canada, Mexico, and China in early February. While the outlook uses a model based on previous tariff assumptions, the EIA will continue to monitor the situation and update its projections as policies evolve.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM