Diamondback Energy announces $4 billion acquisition

February 18, 2025

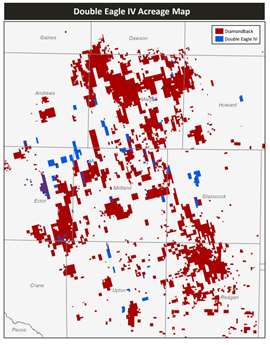

Deal includes large swath in Midland Basin

Diamondback Energy will acquire certain subsidiaries of Double Eagle IV Midco in a deal valued at approximately US$3 billion in cash and additional company stock.

This acquisition represents a significant expansion of Diamondback’s footprint in the highly lucrative Midland Basin, with an additional 40,000 net acres and a rich inventory of undeveloped land. The assets are expected to increase Diamondback’s core position in the region, which will further enhance the company’s long-term prospects.

The acquired assets, which have an estimated 407 gross locations and 342 net horizontal locations, include some of the most attractive remaining acreage in the basin. The assets are poised to generate strong production growth, with a projected 27 MBo/d run-rate production, 69% of which is oil. Diamondback aims to accelerate development on the acreage, including some of its non-core southern Midland Basin properties, in a move expected to bring forward the company’s net asset value (NAV) significantly.

As part of its broader strategy, Diamondback is also committing to divest at least $1.5 billion in non-core assets. This will help reduce the company’s pro forma debt and preserve its robust balance sheet, targeting a net debt reduction to $10 billion with an ongoing commitment to maintain leverage between $6 billion to $8 billion.

Travis Stice, Chairman and CEO of Diamondback, expressed confidence in the deal, stating, “Double Eagle represents the most attractive asset remaining in the Midland Basin, and its proximity to our existing acreage will allow for significant synergies in infrastructure and operational efficiency. We’re eager to leverage our industry-leading cost structure to unlock value from this differentiated asset.”

The deal also solidifies Diamondback’s strategy to expand its inventory of high-quality, low-breakeven assets in the Permian Basin, where consolidation has been intensifying. Despite the addition of leverage to finance the acquisition, Diamondback is confident that its robust cash flow and asset sales will allow for a swift reduction in debt.

“We are excited to announce our agreement with Diamondback,” said Cody Campbell and John Sellers, Co-CEOs of Double Eagle. “Our team has built a premier asset, and we are confident that Diamondback, with its world-class operational expertise, will maximize the value of this asset while continuing to have a positive impact on the community in West Texas.”

The transaction, which is expected to close on April 1, 2025, remains subject to customary closing conditions and regulatory approval.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM