Dallas Fed Energy Survey shows signs of optimism

January 02, 2025

Cost pressures remain, however

The latest Dallas Federal Reserve Energy Survey has revealed mixed but generally positive trends in the energy sector for the fourth quarter of 2024, indicating a mild recovery and cautious optimism among energy executives.

The business activity index, the survey’s broadest measure of industry conditions, rose significantly, moving from -5.9 in Q3 to 6.0 in Q4. This shift marks a noticeable improvement in the sector’s overall health within the Eleventh District. Similarly, the company outlook index turned positive for the first time in several quarters, climbing 19 points from -12.1 to 7.1, suggesting a mild sense of optimism for the future. However, uncertainty about the industry’s trajectory has also declined, with the outlook uncertainty index dropping 26 points to 22.4.

Oil and gas production exhibited mixed performance. The oil production index remained in positive territory but fell sharply from 7.9 in Q3 to 1.1 in Q4, signaling that oil output remained largely stable during the period. On the other hand, the natural gas production index improved slightly, though it stayed negative, rising from -13.3 to -3.5, suggesting a slight decline in natural gas output.

Despite these mixed production trends, cost pressures remained steady across the sector. Among oilfield services firms, the input cost index remained virtually unchanged at 23.9, while exploration and production (E&P) firms saw a slight uptick in lease operating expenses, with the index moving from 21.3 to 25.6. Finding and development costs held steady at 11.5, signaling that firms are adjusting to a consistent cost environment.

Employment in the sector showed little change, with the aggregate employment index holding steady at 2.2, indicating that hiring remains muted. The wages and benefits index increased slightly from 18.6 to 21.7, suggesting moderate wage growth in the industry.

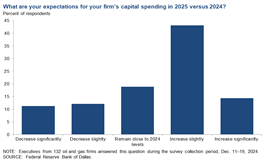

Looking ahead, executives are cautiously optimistic about capital spending in 2025. Forty-three percent of executives anticipate a slight increase in capital expenditure, while 14% expect a significant rise. However, 23% of executives foresee a decrease in capital spending next year. A breakdown by company size showed that larger E&P firms are more likely to predict a decrease in spending, while smaller firms and oilfield services firms were more inclined to expect slight increases.

Regarding oil price expectations, survey respondents are anticipating a WTI oil price of $71 per barrel by year-end 2025, with a range of responses between $53 and $100 per barrel. Long-term expectations are similarly steady, with an average WTI price forecast of $74 per barrel two years from now and $80 per barrel five years from now. As of the survey period, WTI spot prices averaged $70.66 per barrel.

The survey also touched on plans for environmental mitigation. Large E&P firms are leading efforts to reduce carbon dioxide and methane emissions, with 57% planning to cut CO2 emissions, 64% planning to reduce methane emissions, and 86% targeting a reduction in flaring. Smaller firms, however, are less focused on environmental goals, with only 18% planning to reduce carbon emissions and 29% aiming to reduce methane emissions.

In a positive sign for regulatory efficiency, most executives expect permitting times for drilling wells on federal lands to improve over the next four years, with 35% anticipating a slight decrease and 33% expecting significantly quicker permitting.

The survey, which gathered responses from 134 energy firms between Dec. 11-19, reflects an industry in flux, cautiously optimistic about future growth despite ongoing production and cost challenges. The next release of the Dallas Fed Energy Survey is scheduled for March 26, 2025.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM