EIA: Gas price to remain below $2.00/MMBtu until late in the year

11 April 2024

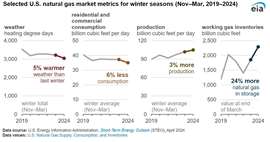

Warm winter leads to spike in storage

U.S. working natural gas inventories ended the winter heating season (November 1–March 31) at 2,290 Bcf, 39% more than the previous five-year (2019–23) average, according to the U.S. Energy Information Administration (EIA).

Relatively high natural gas inventories all winter contributed to record-low Henry Hub natural gas spot prices. The surplus to the five-year average grew over winter 2023–24 because of mild weather, low natural gas consumption, and high natural gas production. In its April Short-Term Energy Outlook (STEO), the EIA expects natural gas inventories to remain relatively high and natural gas spot prices to remain relatively low through 2025.

“We changed our forecast for natural gas prices for the remainer of 2024 based on the recent record-low Henry Hub spot price and the persistently high natural gas inventories,” the EIA states. “In the October STEO, we forecast the Henry Hub spot price to average $3.20/MMBtu in 2024. We now forecast the Henry Hub price to remain below $2.00/MMBtu until the second half of 2024 and to average $2.20/MMBtu for the year. We still expect the natural gas price to increase from the March 2024 low as production curtailments and increased natural gas consumption for electricity generation bring supply and demand closer to balance.”

According to the National Oceanic and Atmospheric Administration (NOAA), the United States just experienced its warmest winter on record. Since October 2023, the residential and commercial sectors consumed less natural gas than during previous winters, and less natural gas was withdrawn from storage: about 1,500 Bcf this winter versus 2,000 Bcf in previous winters.

Except for a winter storm in mid-January, relatively mild weather from November 2023 through March 2024 resulted in natural gas consumption in the U.S. residential and commercial sectors averaging 35 Bcf/d, 6% less than in the winter of 2022–23 and 7% less than the previous five-year average. Less consumption this winter contributed to below-average natural gas storage withdrawals and higher natural gas inventories.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM