EIA: Even with low prices, volatility high in ’24

04 June 2024

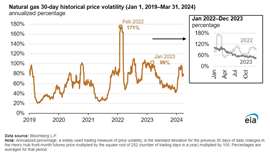

Price volatility generally fell in U.S. natural gas markets throughout 2023

After a historically volatile 2022, prices for U.S. natural gas even out in 2023, according to the U.S. Energy Information Administration (EIA).

But even with lower prices in 2024, historical volatility has spiked again.

Historical volatility, a measure of daily price changes relative to average prices, eased from the recent highs reached in 2022, the EIA reported.

“The measure of historical volatility we use here, which relates short-term price movements to average prices over a defined period, reached 171% for U.S. wholesale natural gas in February 2022, the most volatile since at least 1994,” according to the EIA. “This 30-day historical volatility of U.S. natural gas prices is based on the U.S. benchmark Henry Hub front-month futures price. It averaged 69% in 2023 compared with 91% across all of 2022.”

This approach to volatility is deliberately independent of how high prices are on average, the EIA said. The lower historical wholesale natural gas volatility observed in 2023 came in addition to lower prices. So far in 2024, increased historical volatility has occurred even as prices have fallen to record lows.

After peaking in February 2022, monthly average historical natural gas price volatility was generally lower through the second quarter until increasing again in July to 105%. U.S. wholesale natural gas prices were particularly volatile in 2022 because of additional uncertainty caused, in part, by increased European demand for liquefied natural gas (LNG) following Russia’s full-scale invasion of Ukraine in February and the explosion at the Freeport LNG export terminal in June.

In 2023, historical wholesale natural gas price volatility peaked in January at an average of 99% and averaged 96% in the first quarter. At the same time, natural gas prices declined by 41% in January 2023 compared with December 2022, driven by less natural gas consumption for space heating because of warmer-than-average temperatures, increased natural gas production in the United States, and increased storage inventories. Less consumption and more production reduced natural gas withdrawals from storage in January by 55%, or 371 billion cubic feet, compared with the five-year (2018–22) average.

Historical price volatility generally fell in U.S. natural gas markets throughout 2023. On average, volatility reached a monthly low of 47% in December, the warmest on record in many U.S. locations, as less natural gas was consumed compared with December 2022 and as record monthly U.S. natural gas production reached its peak. Throughout 2023, with inventories of natural gas well above the five-year (2018–22) average and with no major disruptions that significantly changed market conditions, historical price volatility fell compared with 2022.

In 2023, the Henry Hub front-month futures price declined to average $2.66 per million British thermal units (MMBtu) compared with $6.54/MMBtu in 2022. Although it has been rising recently, the front-month Henry Hub natural gas futures price averaged $2.10/MMBtu in the first quarter of 2024 as its historical volatility averaged 80%.

In early 2024, the historical price volatility of wholesale U.S. natural gas averaged 92% in February. Disruptions to natural gas production, increased consumption to meet space-heating demand, and the third-largest withdrawal from natural gas storage on record for the week ending Jan. 19, 2024, all due to Winter Storm Heather in January, contributed to increased historical volatility of wholesale U.S. natural gas prices.

Uncertainty about market conditions that affect natural gas supply and demand affect the volatility of prices. Consequently, significant amounts of natural gas in storage can make these uncertainties less critical and reduce exposure to volatility. According to the latest weekly report, as of May 24, almost 27% more natural gas was held in U.S. storage than at the same time of the year on average for the last five years.

(Image: Volatility)

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM