U.S. natural gas rig count declines amid record-setting low prices, EIA reports

March 05, 2025

Downturn pronounced in Haynesville, Appalachia

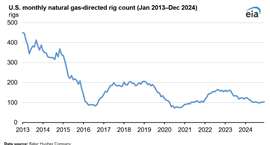

The number of rigs deployed for natural gas drilling in the United States has fallen significantly over the past two years, reflecting a sharp decline in prices and changing economic conditions, according to the U.S. Energy Information Administration (EIA).

From December 2022 to December 2024, the number of natural gas-directed rigs decreased by 32%, a drop of 50 rigs. The downturn has been especially pronounced in key natural gas-rich regions like Haynesville and Appalachia. In these areas, the rig count fell by 34% (43 rigs) in 2023 and 24% (21 rigs) in 2024.

This decline in drilling activity comes amid historically low natural gas prices, which hit record lows throughout much of 2024. The EIA notes that U.S. benchmark natural gas prices, which surged to $6.95 per million British thermal units (MMBtu) in 2022, have since dropped dramatically. By 2024, prices plummeted 62% in 2023 to $4.31/MMBtu, followed by an additional 16% drop to just $0.43/MMBtu, with March 2024 marking the lowest price recorded after adjusting for inflation at $1.51/MMBtu.

The steep price drop has hit higher-cost regions like Haynesville particularly hard. Spanning parts of Texas and Louisiana, the Haynesville is known for its deeper drilling, with wells typically reaching between 10,500 and 13,500 feet. The EIA reports a 55% decline in rigs in the region since December 2022, as drilling at these depths has become increasingly unprofitable. Correspondingly, marketed natural gas production in Haynesville has dropped 7% over the same period.

Similarly, the Appalachia region, which includes the Marcellus and Utica shale plays, has experienced a 37% drop in rig counts since December 2022. The lower drilling activity has limited growth in marketed natural gas production to just 4% during the same time frame.

Industry experts suggest that producers are scaling back operations in response to volatile and low prices. Factors such as uncertainty over future pricing, market volatility, and the cost of materials, labor, and transportation all play a role in drilling decisions. Despite the decline in rigs, some producers are holding onto drilled but uncompleted wells, hoping for a price rebound that would make completing these wells economically viable.

As natural gas prices begin to stabilize, especially if demand increases, producers may be in a position to quickly ramp up production by completing these idle wells, potentially boosting U.S. natural gas output in the near future.

The full report by the EIA highlights the ongoing shifts in the U.S. natural gas sector as producers adjust to fluctuating market conditions.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM