Europe’s import capacity to reach 400 bcm in 2030

March 28, 2023

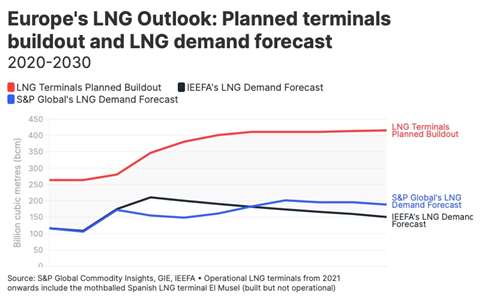

Projections for Europe’s LNG buildout and demand from 2020-2030 (Courtesy of IEEFA)

Projections for Europe’s LNG buildout and demand from 2020-2030 (Courtesy of IEEFA)

The Institute for Energy Economics and Financial Analysis (IEEFA) has launched the European LNG Tracker, and the institute is forecasting Europe to reach 400 billion cubic meters (bcm) of LNG import capacity by 2030, based on current infrastructure buildout plans, which would be a dramatic increase from the 270 bcm recorded at the end of 2022.

IEEFA’s tracker, the first publicly available interactive data set to visualize Europe’s LNG outlook, is also predicting the demand for LNG to be approximately 150 bcm in 2030 – additionally, S&P Global Commodity Insights is forecasting a slightly higher LNG demand figure of 190 bcm by 2030.

The gap, approximately 250 bcm of unused capacity, between the projected 400 bcm buildout and the 150-190 bcm in demand would be more than half of the EU’s total gas consumption in 2021 (413 bcm).

“This is the world’s most expensive and unnecessary insurance policy,” said Ana Maria Jaller Makarewicz, author of the tracker analysis and energy analyst for IEEFA Europe. “Europe must carefully balance its gas and LNG systems, and avoid tipping the scale from reliability to redundancy. Boosting Europe’s LNG infrastructure will not necessarily increase reliability — there’s a tangible risk that assets could become stranded.”

According to the IEEFA, new LNG projects in Europe are pushing the continent to boost its capacity by one-third, but there is a discrepancy between regasification infrastructure being built and planned LNG demand across all the countries recorded by the tracker.

The countries with the forecasted highest risk of unused gas capacity are Spain (50 bcm), Turkey (44 bcm), the UK (40 bcm), France (14 bcm), Italy (10 bcm) and Germany (9 bcm).

Several countries have announced new LNG projects or the expansion of existing ones in a bid to cut ties to Russian LNG exports (due to the ongoing war in Ukraine), including Germany, which leads all European countries with three onshore projects and six floating storage regasification units (FSRU).

Italy (two FSRUs), Greece (two FSRUs), Netherlands (one FSRU), and France (one FSRU) are also growing their LNG projects.

IEEFA is forecasting a 36% utilization rate of Europe’s LNG terminals by 2030, including those that are currently under construction or in planning stages.

“Over-engineered networks are expensive to build and maintain,” Jaller Makarewicz said. “Decisions to expand Europe’s LNG infrastructure must be based on future demand needs and take into account that the EU is planning to reduce gas demand by at least one-third by 2030.”

According to the IEEFA, demand for LNG is expected to increase in 2023 and then decline in the following years, mainly due to forecasted gas demand reductions across EU countries.

Recently, LNG imports into Europe increased by 60% in 2022 compared to 2021, mostly from the top three exporters: the US (+143%), Qatar (+23%) and Russia (+12%). On the European side, Belgium had the biggest increase (+136%) of LNG imports in 2022 compared to 2021, with France (+96%), Netherlands (+94%), Lithuania (+88%) and the UK (+71%) also growing their LNG imports last year.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM