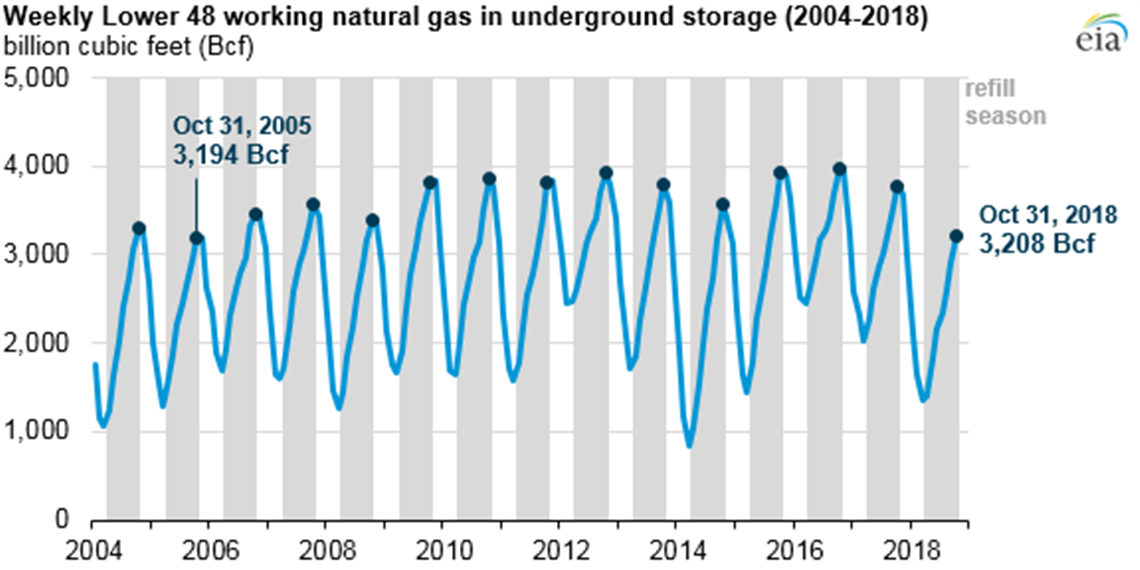

EIA: Natural Gas Stocks End Refill Season At Lowest Level In 13 Years

15 November 2018

Working natural gas in underground storage in the Lower 48 states as of Oct. 31 totaled 3,208 billion cubic feet (Bcf), according to data from the U.S. Energy Information Agency—the lowest inventory levels for the Lower 48 states and in each of the U.S. natural gas regions since October 2005, and considerably lower than their previous five-year averages.

The South Central region saw the largest margin between the five-year range and working natural gas storage levels at the end of October, reaching 932 Bcf, 159 Bcf (15%) lower than the previous five-year range. The Pacific saw the largest percent difference between the end-of-season levels and the five-year range, at 264 Bcf, or 54 Bcf (17%) lower. Other regions were 3% to 7% lower than the previous five-year range.

A low starting inventory level and below-average net injections of natural gas into storage contributed to working natural gas stocks ending the refill season at this relatively low level. Lower-than-average temperatures in April 2018 resulted in uncharacteristic, continued withdrawals from storage during the month. Working natural gas stocks ended the withdrawal season this year on March 31 at 1,360 Bcf—the fourth-lowest level reported since 2005.

Although net injections recovered in the following months, the net increases in working natural gas for the injection season were lower than the five-year average. From April 1 through Oct. 31, EIA estimates that net injections totaled 1,848 Bcf. Injections were 269 Bcf (13%) lower than the five-year average, despite being 97 Bcf (6%) higher than injections last year. This level was the fourth-lowest net injected volume for the refill season since 2005.

The South Central and Pacific regions posted the largest differences from the five-year average. In the Pacific region, net injections into storage fell 33 Bcf (26%) lower than the five-year average. In the South Central region, reported net injections totaled 201 Bcf (39%) lower than the five-year average with about 85% of the shortfall occurring in the nonsalt facilities in the region. In the East and Midwest regions, net injections were each 18 Bcf lower than the five-year average (3%). The only region that matched its five-year average net injections was the Mountain region.

Despite increased natural gas production, increased demand for natural gas reduced net injections into working gas storage. Natural gas production averaged 83.6 Bcf/day during the refill season in 2018, compared with 74.7 Bcf/day in 2017 during the same period. However, greater-than-average power sector consumption of natural gas during the late spring and summer, combined with increased natural gas demand from U.S. export markets, resulted in lower-than-average weekly net injections of natural gas into storage.

EIA has developed an interactive dashboard that provides daily and weekly contextual information to the Weekly Natural Gas Storage Report. The new dashboard shows Lower 48 and regional storage activity and key market fundamentals that affect underground natural gas storage activity.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

CONNECT WITH THE TEAM