Draining The Glut

21 August 2017

This article was originally published in the July issue of COMPRESSORtech2. We only publish a fraction of our magazine content online, so for more great content, get every issue in your inbox/mailbox and access to our digital archives with a free subscription.

BY UDAY TURAGA AND BRANDON JOHNSON

Economies around the world are making a conscious shift to reduce their carbon footprint by shifting to natural gas (and renewable power), and the number of countries importing liquefied natural gas (LNG) has been increasingly steadily. Even so, anemic economic growth in Asia has slowed global LNG demand, and that, coupled with rapid growth in LNG supply from Australia and the U.S., has led to an oversupplied global LNG market.

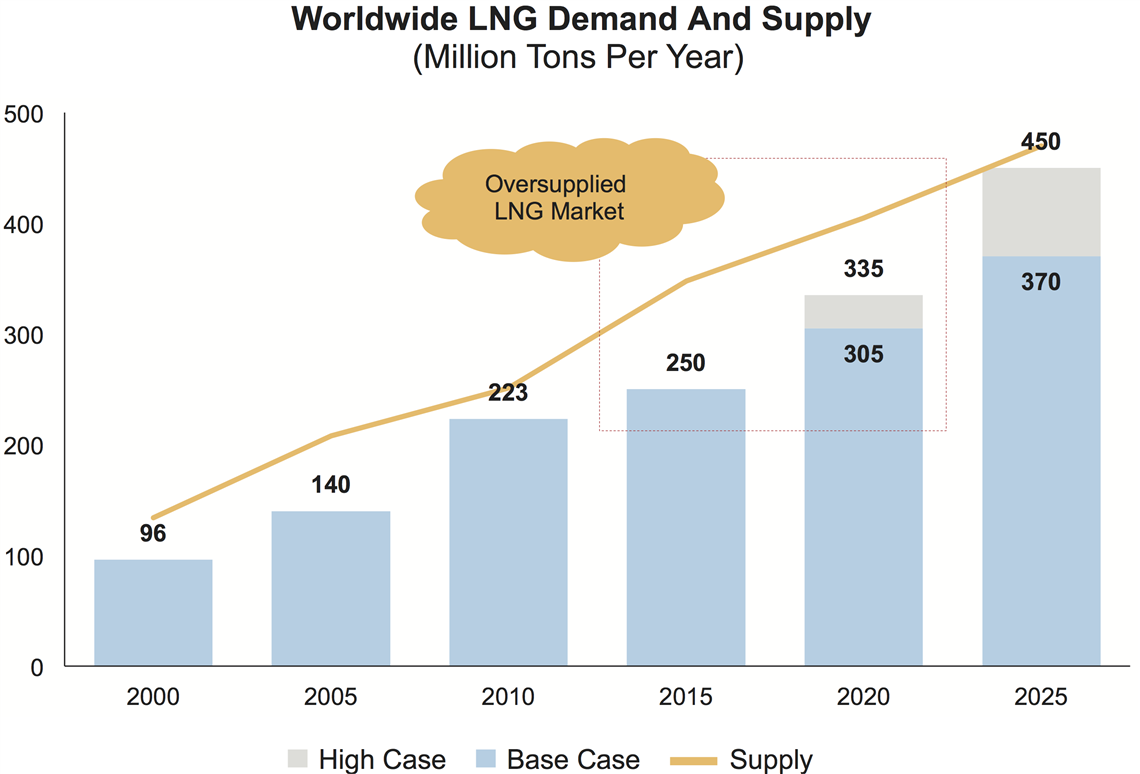

The global LNG market is likely to stay oversupplied through the next three to five years (Figure 1), impacting approvals of new LNG supply projects, potentially driving new demand, and giving an impetus to the development of new LNG technologies.

Asia’s Slower Growth

Countries around the world are adopting regulations to reduce carbon emissions from power plants and trans- portation fuels that are collectively driving demand for

LNG. These include the European Union’s Large Combustion Plant Directive, China’s caps on energy consumption and coal-fired power, and the International Maritime Organization’s sulfur limits on marine fuels. Power generation continues to account for the bulk of LNG demand, although LNG’s use as a fuel for marine vessels is expected to grow slowly.

Asia will continue to drive LNG demand growth, accounting for more than 70% of total imports. Slow economic growth in China and South Korea coupled with nuclear restarts in Japan have hindered LNG demand growth since 2014. This moderation in demand growth from Asia’s largest and traditional LNG importers was offset to a certain extent by new LNG importers such as Egypt, Jordan, Pakistan and Poland.

More LNG capacity

Historically, the Middle East has been one of the largest suppliers of LNG, but significant new capacity is being added in Australia and the U.S. Several new LNG projects are coming on stream in Australia, which are expected to have approximately 66 million tons per annum (mtpa) of LNG export capacity by the middle of this year and approximately 85 mtpa by 2020, positioning it as the world’s largest LNG exporter.

But project delays and potential gas shortages may slow the pace of growth. Four LNG export projects — Chevron’s Gorgon and Wheatstone, Inpex’s Ichthys and Shell’s Prelude — are all experiencing delays, and some of their startups will be delayed from this year to 2018 and potentially later. Another possible disruption is Australia’s domestic shortage of natural gas driving export controls by the Australian government.

Shale gas discoveries in the U.S. are being monetized through several LNG export projects. Cheneire’s Sabine Pass facility was the first large-scale project to export LNG in 2016, and there are several other projects that have secured offtake agreements with buyers and are now under construction. All of the trains that are currently under construction will likely begin to export while other announced projects will have a difficult time receiving regulatory approvals, securing offtake agreements and initiating construction. In total, the U.S. will likely be exporting as much as 74 mtpa of LNG by 2020.

New technologies

The surge in LNG projects over the past decade has spawned new innovations and technologies across the LNG value chain. Floating liquefied natural gas (FLNG) — offshore liquefaction on vessels can impact costs of onshore projects and offer the option of moving capacity to new discoveries — has advanced rapidly. Petronas recently launched the world’s first FLNG vessel, PFLNG1, which has a capacity of 1.2 mtpa and is located in the Kanowit field off the coast of Malaysia.

Another promising technology is floating storage and regasification units (FSRUs), which are floating import terminals that cost nearly half of onshore regasification facilities, can be built twice as fast and moved based on LNG regasification demand. Such innovations will, collectively, improve the cost competitiveness of LNG and drive its demand growth around the world.

In summary, the growing shift to low-carbon energy has not been sufficient to overcome LNG’s slowing demand growth from anemic Asian economies and rising supply from Australia and the U.S. As a result, the global LNG market is oversupplied and unlikely to balance through the next three to five years. That, coupled with new technologies across the value chain, may lower LNG prices and impact approvals of new LNG projects.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

POWER SOURCING GUIDE

The trusted reference and buyer’s guide for 83 years

The original “desktop search engine,” guiding nearly 10,000 users in more than 90 countries it is the primary reference for specifications and details on all the components that go into engine systems.

Visit Now

CONNECT WITH THE TEAM